The Benefits of Diversifying Your Income Streams

Are you looking for ways to reduce your risk and increase your income? If so, you should consider diversifying your income streams. When you have multiple sources of income, it’s much harder for one thing to go wrong and ruin your entire financial stability. This blog post will discuss some tips on how to get started!

Start side hustles

Starting a side hustle can be an excellent way to diversify your income streams and increase your financial stability. Side hustles are flexible, allowing you to create extra income while working around your existing commitments. For example, you could sell feet pictures online at your own pace without having it interfere with your current schedule.

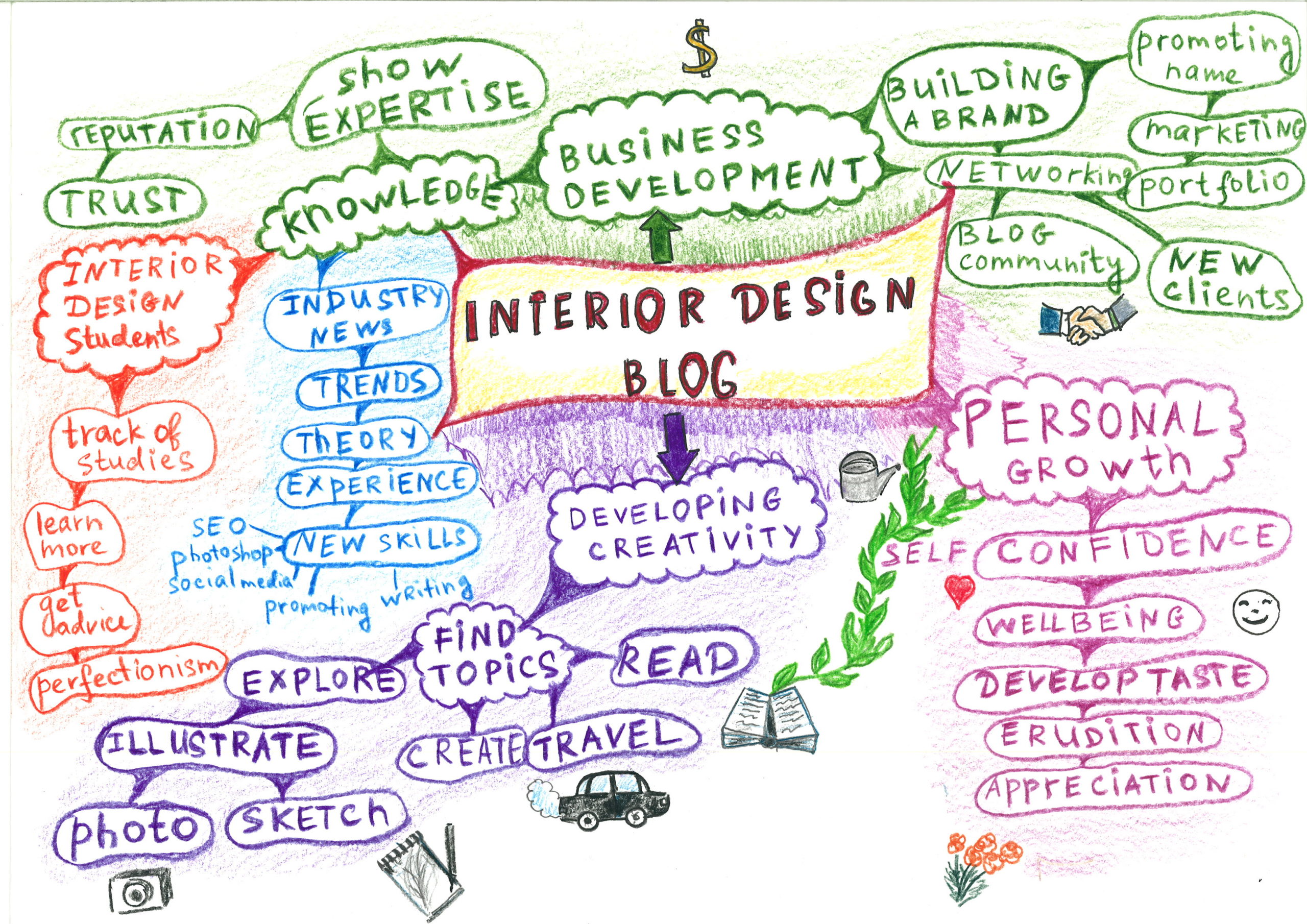

When beginning a side hustle, it is crucial to assess the skills and knowledge you already possess and then think of ways in which these could be monetized. For example, if you have experience in web design, you could start offering your services as a freelance web designer. Alternatively, if you have skills or knowledge in a certain topic, such as social media marketing or writing, you could create an online course and sell it for profit.

It’s also worth considering the type of business model that best suits your lifestyle – for instance, do you prefer to work for yourself or as part of a team? Additionally, make sure to research existing competitors and industry trends before launching any ideas – this way, you can ensure that what you are putting out there is both unique and desirable.

Invest in real estate

Real estate can be an excellent way to diversify your income streams and increase your wealth. Although it requires a large upfront investment, the returns can be substantial if done correctly.

When investing in real estate, you need to conduct thorough research into local markets and rental prices in order to identify potential opportunities for growth. It would be best if you also considered things like the location of the property, how long it will take for it to appreciate, how much maintenance is required, and so on – all of these factors could have a significant impact on its profitability. Additionally, you need to understand the process of buying and selling property before getting started.

Diversify your financial portfolio

Diversifying your financial portfolio is another great way to create multiple streams of income and reduce your risk. This involves investing in a variety of different areas, such as stocks, bonds, mutual funds, ETFs and so on – this way, you can spread out your investments across other asset classes and take advantage of potential opportunities in each one.

When diversifying your financial portfolio, it’s important to think carefully about the types of investments that best suit your particular goals and risk tolerance. It would be best if you also did plenty of research into the markets you’re looking at investing in before committing any money – this way, you can make sure that what you are investing in is low-risk and has potential for growth.

In conclusion, diversifying your income streams can be an excellent way to reduce risk and increase your financial stability. There are a variety of approaches you can take, such as starting side hustles, investing in real estate or diversifying your financial portfolio – all of which have the potential to offer great returns if done correctly. With this in mind, it’s worth taking some time to research the different options available to you and find out what works best for you and your situation.