How to Trade in the Stock Market?

Most would like to start trading in the stock market and get a chance to become wealthy. But in reality, there are not so many successful traders. This type of investment has a lot of advantages, but only those who choose the right strategy can make money on the purchase and sale of securities. Before you get started, you need to have a clear understanding of what the stock market is and what concepts you need to operate with. Then, learn the fundamentals of trading in the stock market to play by the rules of the stock exchange.

What Is the Stock Market: A Clear Picture of It

The stock market is the branch of the financial market where transactions with securities are carried out. It plays an important role in the life of individual enterprises and the state as a whole. Suppose a company wants to develop but does not have such an opportunity due to a lack of funds. Management decides to issue securities. Those who bought them are entitled to a part of the company’s profits. As a result, each side wins.

There are several types of securities:

- The share confirms that its holder has the right to a part of the capital of the joint-stock company. The shareholder receives income in the form of dividends. If the company closes, the owner of the shares can count on the part of the property, depending on the number of securities. The controlling shareholder usually has the right to participate in the management of the enterprise.

- Bonds are debt securities that give the investor a return in the form of interest. For the company, their release is akin to lending, but on more favorable terms, since the rate is lower than in a bank. As a result, the investor receives a profit from interest and, at the same time, doesn’t risk anything. In addition, the company redeems the bonds themselves at the time specified in the agreement.

- In its simplest form, a promissory note is similar to an IOU. The debtor who issued the security undertakes to pay the due amount to the creditor within the prescribed period. Bills can be bought and sold, and you can also pay with them. This type of security is circulated less frequently than those described above.

In addition to the actual securities on the stock market, there are their derivatives. For example, trading in futures is especially common. Check the wedge pattern in stocks, futures, bonds, etc., to know if it’s rising or falling.

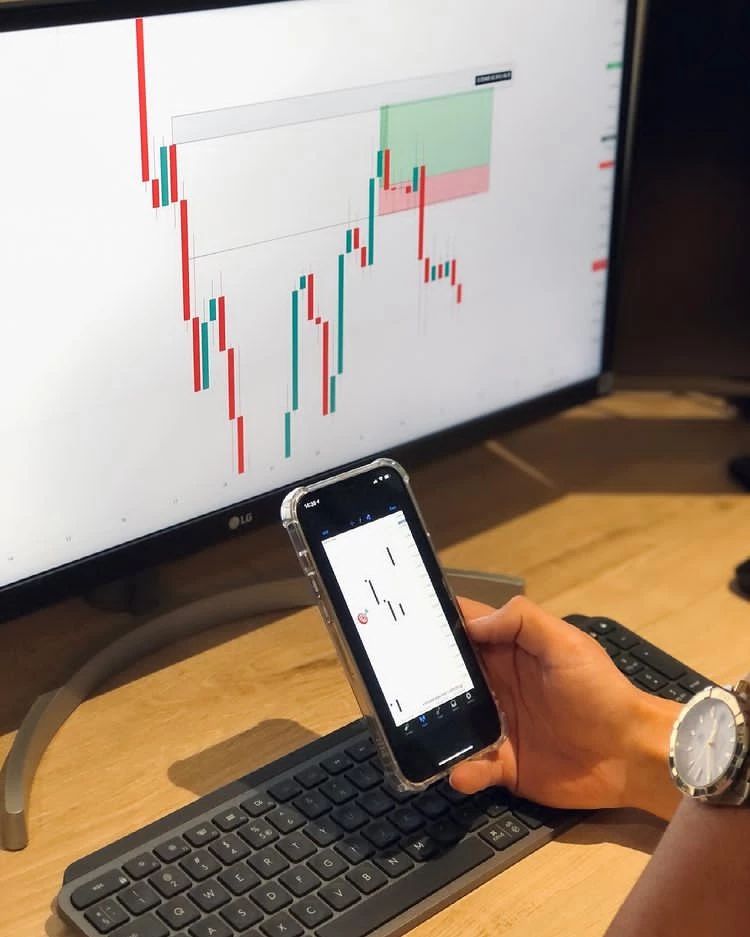

Online Trading and Its Key Benefits

With the development of the Internet, this type of trade has become the main one. Its advantages are undeniable:

- Availability. With the appropriate training, anyone can become a trader. It doesn’t require a license or large capital.

- Ease of transactions. The Internet has automated this process as much as possible.

- Access to a large number of platforms, the ability to work on the exchange, and over-the-counter markets.

- Speed of transactions: the Internet provides instant communication with the broker.

- Ability to trade from home or anywhere else.

- Round-the-clock work, no connection to the exchange session.

- Tracking quotes and viewing news in real time.

- Independence. The trader makes decisions at their own discretion, without the participation of a broker.

Choosing the Only Right Strategy Is the Way to Success

The key to profitable trades is the right choice of strategy. That is why newcomers who enter the stock market hoping to make easy money often end up at a loss. A balanced approach involves professional training in trading in the stock market. It’s worth getting started only after mastering the theory and practice of trading.

It makes sense to start choosing one of the existing strategies and then, as you gain experience, perhaps develop your own strategy. There are many strategies for trading in the stock market. All of them fit into the framework of several styles.

- Scalping strategies are short-term, based on small time intervals (timeframes). Let’s explain what this means. Securities prices fluctuate continuously throughout the day. If you make, say, one or two transactions within a session, the fluctuation chart will be relatively calm. The risk, in this case, is lower, but the possible profit is also less. When scalping, a trader opens trades every 1-2 minutes. With this strategy, the charts jerk sharply up and down. It is difficult to predict the dynamics by technical analysis in such a situation, so special benchmarks are usually used – indicators.

- Day trading. It is not as stressful as scalping as it involves trading on longer timeframes but also within the same day. To predict the dynamics of fluctuations, a trader resorts to technical analysis. As a result, the number of transactions within a session is less than with scalping. This style is suitable for beginner traders: it allows you to gain experience in a fairly calm environment without risking large sums.

- Investment strategies. Private traders sometimes practice long-term holding of assets. Investment strategies can be conditionally divided into short-term (up to a year), medium-term, and long-term (more than 3 years). Fluctuations in securities quotes are predicted by the method of fundamental analysis.

Making money by trading in the stock market is absolutely real. The indispensable conditions for successful trading are the ability to analyse the financial market and deep theoretical and practical knowledge.